Overview

of the 2009 AIA Firm Survey

Comprehensive data on firm business trends just released

Summary: The

AIA published The Business of Architecture:

An AIA Survey Report on Firm Characteristics on October 5. Based on an analysis of 2,699

AIA-member firm responses collected between January and March 2009,

the report is available on-line from the AIA Bookstore. To provide

a comprehensive sense of the information covered in the survey, we

offer here a reprint of the survey overview.

With U.S. architecture firms and the related construction industry

in the midst of its worst downturn of several generations, it’s

easy to forget the solid performance of the profession over the 2005

to 2008 period. This three-year period coincided with the end of

one of the strongest housing booms in our history, as well as a time

when businesses were investing in new facilities to support the healthy

growth in the broader economy.

Even when the housing downturn hit in early 2006, there was sufficient

momentum in the commercial, industrial, and institutional markets

to support solid growth across the profession. By 2008, however,

as the economy was entering a recession, design work at architecture

firms began to slow and then dropped precipitously once credit markets

collapsed toward the end of summer.

For the past two decades, the AIA has conducted periodic surveys

of its member firms. The purpose of these surveys is to document

emerging trends in the practice of architecture and assess how they

interact with economic trends and technological developments. These

Business of Architecture reports present benchmarks that allow firms

to assess their practices and evaluate their operations in comparison

to their peers. In this way, the architecture profession can monitor

its progress toward achieving financial stability while pursuing

shared goals for the larger architecture community. This document

reports results from a scientifically selected survey of 2,700 architecture

firms conducted in early 2009, reporting firm characteristics and

operations in 2008 and comparing these results to earlier surveys

to assess how the profession is changing. Unless otherwise specified,

all information in this report was generated by the AIA.

Economic climate is changing

As economic expansions go, this past

one generated overall favorable business conditions for architecture

firms. Beginning in early 2002, as it emerged from the last recession,

the U.S. economy saw steady growth until the next recession began

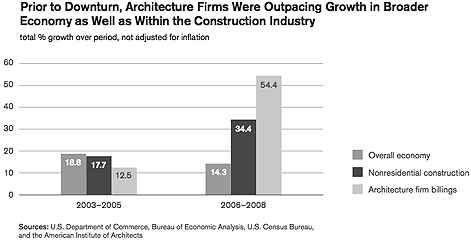

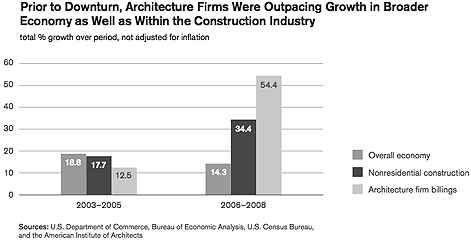

in early 2008. The 2003–2005

period saw growth average just about 6 percent per year before inflation

adjustments, while the 2006–2008 period saw economic growth

slow to just under 5 percent per year as the economy headed into

recession in 2008.

Nonresidential construction saw a very different pattern over this

period. Early in economic cycles, as businesses are in recovery mode,

they tend to spend less on investments such as new or modernized

facilities. So, for example, during the past cycle, even though an

economic recovery was under way by 2002, business investment in structures

didn’t begin to rebound until well into 2004, according to

U.S. Commerce Department figures.

However, once under way, spending accelerated very rapidly during

the second half of this cycle, with the Commerce Department reporting

double-digit annual gains on average in non-residential investment

in structures over the 2006–2008 period. The U.S. Census Bureau

reported that nonresidential construction spending increased by more

than 60 34 percent from the end of 2005 to the 50 end of 2008, just

about twice the total growth of the prior three-year period.

Architecture firms benefited greatly from this acceleration of nonresidential

activity. Billings at firms rose sharply between 2005 and 2008: gross

billings were up more than 50 percent due to the spike in pass-throughs,

while net billings increased more than 40 percent from 2005 levels.

The surprisingly strong growth in billings at firms over this period

underscores the “boom or bust” nature of construction

activity and the resulting volatility in revenue at design firms

serving this industry. So, for example, even though the economy grew

at a fairly stable rate over the 2002 to 2008 period, growth in architecture

firm revenue was very modest during the first half of the period

and extremely strong during the second half.

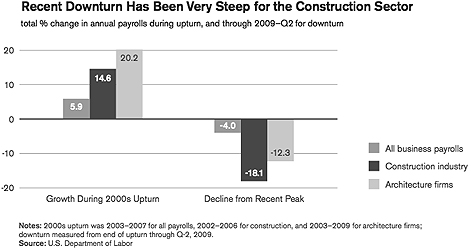

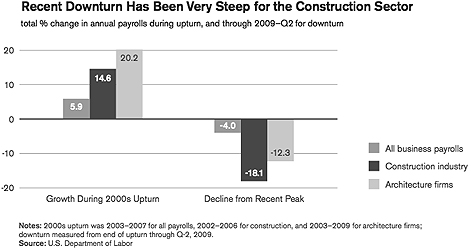

This typical volatility in business conditions at architecture firms

that produced strong growth during the past upturn also generally

produces steep declines during downturns. At the time of this report,

the full extent of the downturn from the recession is unknown, but

it is clear that it will be substantial. Payroll figures, which are

available from the U.S. Department of Labor for a wide range of industries,

already point to a major downsizing of staff at many businesses.

For example, from their peak in 2007 through midyear 2009, U.S. business

payrolls have declined by 5.5 million positions; this decline translates

into 4 percent of all payroll positions nationally, which almost

offsets the total number of payroll jobs added during the upturn

earlier in the decade.

The construction industry has seen a more dramatic downturn. From

its high-water mark in 2006, when the residential sector began to

weaken, through mid-2009, payrolls at construction firms declined

by over 18 percent, more than offsetting all of the job gains during

the upturn earlier in the decade. Payrolls at architecture firms

have followed a similar path. The downturn began later, however,

as the annual peak was in 2008. Still, through the middle of 2009,

payrolls at architecture firms declined by over 12 percent, offsetting

a majority of the gains realized during the upturn.

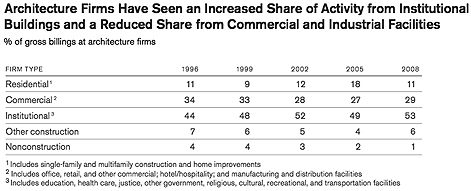

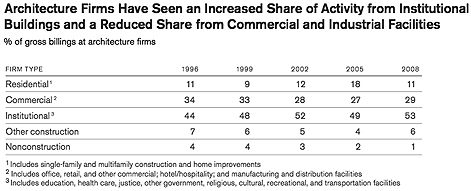

With a changing construction sector, firms see shifting workloads

Not only did workloads at architecture firms grow dramatically over

the 2006–2008 period, but the composition of those workloads

also shifted. Since the mid-1990s, work on residential facilities

has averaged about 10 to 12 percent of total billings at architecture

firms. However, with the strong growth in homebuilding earlier this

decade, by 2005 residential projects accounted for 18 percent of

billings. By 2008, this share had fallen back closer to its longer

term average.

The increased share of residential work in 2005 offset a downward

trend in commercial construction. That year was still early in the

nonresidential recovery, so commercial design activity was still

below its longer term trend. By 2008, however, commercial activity

had recovered closer to its normal share. Institutional activity,

in contrast, has gradually been increasing its share of design activity

at architecture firms. There was a brief step back in this trend

in 2005, but by 2008 the institutional share was at its highest level

in at least the past 15 years.

The share of activity by construction sector is likely to continue

to shift depending on the position of the construction cycle. As

the economy begins to head in to the next recovery, the residential

market should be the first to rebound, and therefore residential

billings can be expected to increase in share. The nonresidential

downturn is likely to last longer and expected to be the most severe

for commercial facilities, so the commercial share probably will

decline in the near-term.

In spite of some high-profile mergers over the past several years,

architecture firms remain highly fragmented. Almost 80 percent of

AIA member-owned architecture firms had fewer than 10 employees as

of the end of 2008, with just 2 percent of firms reporting 100 or

more employees. With the extensive downsizing at many firms in the

latter part of 2008 and into 2009, it’s likely that many downsized

architects set up smaller practices, further reducing the firm-size

concentration.

Even with the high share of smaller firms, larger firms continue

to account for a large share of activity. By the end of 2008, firms

with 50 or more employees accounted for 44 percent of all staff employed

at architecture firms nationally and over half of all revenue generated

by architecture firms. The small share of firms with 100 or more

employees accounted for 30 percent of all employment and over a third

of all billings. As the construction markets recover and expand,

it is likely that the architecture profession will see a new round

of consolidation. Before the current downturn, many firms were diversifying

into foreign markets to take advantage of international growth opportunities.

Others were diversifying into other regions of the country and across

a broader mix of facility types. This diversification is generally

associated with organic internal growth or merger and acquisition

activity, so as diversification continues, in all likelihood so will

greater consolidation of firms.

Composition of firms changing to accommodate transformation As the

types of construction projects and services offered by architecture

firms have evolved, so has the composition of these firms. One sign

of this is the makeup of the staff at firms. Over the past several

years, the share of architecture staff at firms has generally trended

downward, standing at 60 percent at the end of 2008.

Even more significant than the portion of the staff that provides

architectural services is the composition of this staff. The share

of licensed architects on staff has been trending down, while the

share of nonlicensed graduates of architecture programs not currently

on a licensure path has been steadily increasing. As of this survey,

interns and students as a share of architecture staff declined substantially,

which may be just a temporary trend as firms were scaling back on

less experienced staff when workloads began to slow in 2008.

However, there are likely to be long-term implications of what may

appear to be short-term downsizing. When laid off, interns and other

younger staff have a more difficult time finding work in the architecture

profession. Few other architecture firms are hiring, and it is very

difficult for younger professionals to set up their own practice

in this economic environment. Some will be able to wait out the downturn

and rejoin the profession after the industry recovers. Others will

seek employment in alternative professions, and for these young professionals,

the longer they are outside of the profession the more difficult

it will be for them ever to reintegrate. Their technical skills may

erode over time, and they may take on financial commitments that

make starting over at an architecture firm a difficult financial

choice. Experience shows that during previous major construction

industry downturns, large shares of younger professionals who temporarily

cannot find employment at architecture firms move on to other careers

and never return to architecture, thereby creating a “lost

legion” of younger professionals. During subsequent expansions,

many firms note a shortage of experienced staff due to these previous

losses.

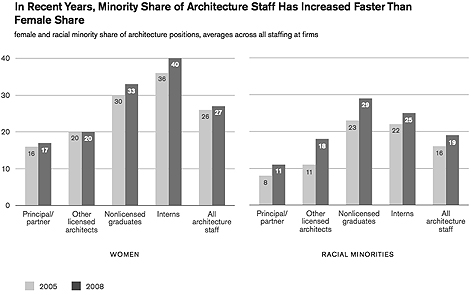

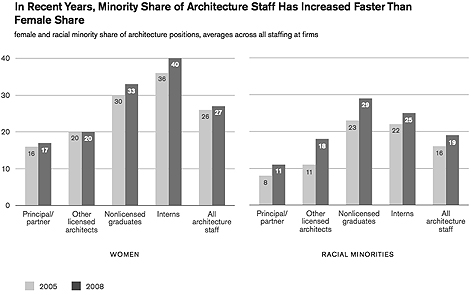

The shifting composition of architecture staff at firms in recent

years has been accompanied by a fairly dramatic shift in their diversity.

Women now account for over a quarter of all architecture staff at

firms, and this share has been slowly increasing. However, there

has been very little change in the composition of firm principals

and partners or in other licensed architects by gender. Rather, most

of the change has come in other positions, as the female share of

nonlicensed architects increased from 30 percent to 33 percent between

2005 and 2008, while their share of interns increased from 36 percent

to 40 percent. Increases in shares in these positions may portend

future increases in shares for women in licensed architect and principal/partner

positions, or it may indicate that there are other barriers to women

achieving these positions in shares comparable to their composition

in the broader profession.

Recent trends have been somewhat different for racial minorities.

Not only has there been more significant growth in the share of racial

minorities in architecture positions at firms in recent years, but

the incidence of this increase across architecture positions has

been more balanced. The most significant increases in share have

been in licensed architect (up 7 percentage points between 2005 and

2008) and nonlicensed graduate (up 6 points over this period) positions,

but there also has been considerable growth in share for principal/partner

and intern positions. Still, there remains a sizable gap between

the racial minority share in intern and nonlicensed graduate positions

(over a quarter of the total in each) as compared to their share

of licensed architect or principal/partner positions (under 20 percent).

|