Even With General Housing Downsizing, Energy Efficiency Options Remain Popular

Home offices are the most popular special-function

room as more workers are home-based

by Kermit Baker, PhD, Hon. AIA

AIA Chief Economist

Summary: With pressure on home sizes and prices, households are scaling back on special features in their homes. Special-function rooms like home theaters, exercise rooms, and guest wings are declining in popularity, as are upscale home features like three-car garages. However, households continue to add options for energy efficiency and management, other sustainability features, and low maintenance products.

From a business perspective, residential architects are beginning

to see stabilizing conditions, with project backlogs near their low

point in all likelihood. Conditions are the most positive in the

Northeast and West, even though they have not yet recovered in any

region. The weakest residential market at present is for second and

vacation homes, with continued softness in the townhouse/condo, custom/luxury,

and move-up construction sectors. The entry level market, which was

the first to soften when the residential recession began in early

2006, is now seeing strong movement toward a recovery. Home improvement

activity is still reported as reasonably healthy by residential architects.

These are some key findings from the American Institute of Architects’ Home

Design Trends Survey from the second quarter of 2009. This survey

focused on home features, systems, and products that are gaining

popularity in the home. Almost five hundred residential architects,

covering all facets of the residential design profession, were surveyed

on emerging design preferences of households.

Downturn has scaled back amenities Downturn has scaled back amenities

The prolonged downturn in the residential market has served to scale back the size and amenities that households are looking for as they make their housing and home improvement decisions. Still, households are using their homes as intensely as ever, so they are not merely down-scaling their housing choices, but seeking features that they desire in the evolving economic environment. For example, home offices continue to be very popular special function rooms within homes. They may be used to limit commuting to work, or as the principal office for a growing number of self-employed workers and small businesses.

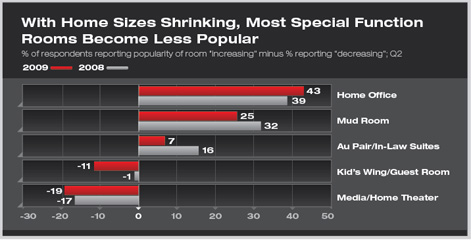

Mud rooms and media rooms/home theaters are the next most popular special function rooms according to residential architects. While mud rooms have held their popularity, media rooms and home theaters are a less popular special function room than they were a year or two ago when the housing market was stronger.

Home offices have increased in popularity from a year ago. In contrast, other popular special function rooms—mudrooms, au pair/in-law suites, hobby/game rooms, home workshops—all had higher popularity scores in 2008. Several special function rooms—kid’s wing/guest wing, media room/ home theater, exercise/fitness room, dual master bedrooms, second laundry room, and pet rooms were all deemed to be declining in consumer interest according to residential architects.

Even with weak market conditions, sustainability and accessibility still popular

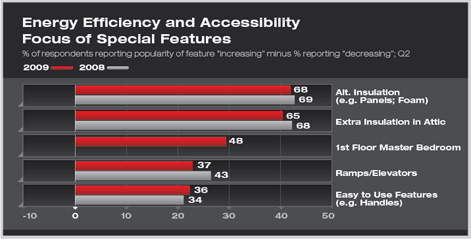

In recent years, homes generally have been simpler with fewer upscale features as the housing market has softened. For example, respondents report a declining interest in three-car garages. However, some home features have retained, or even increased their popularity in this environment. Energy efficiency tops the list of features that households are requesting. Two-thirds of respondents reported both alternative home insulation techniques (e.g. structural foam insulation panels or sprayed foam insulation) and extra insulation in the attic to be increasing in popularity in the second-quarter AIA Home Design Trends Survey, with hardly any indicating that either was decreasing in popularity.

Other popular special home features are aimed at improving accessibility in the home. First-floor master bedroom suites, ramps and elevators, and easy-to-use elements (e.g. handles and faucets) all were identified as popular special features, and in all cases a high share of respondents indicated that they were growing in popularity, with few pointing to decreasing interest on the part of households.

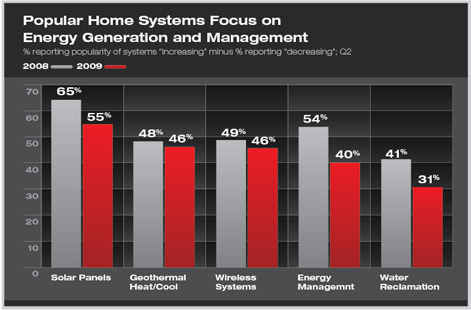

Likewise, popular systems and technologies in homes often are focused on energy efficiency and other sustainability concerns. Solar panels/collectors/photovoltaics and geothermal heating and cooling heat pumps were both seen to be increasing in popularity by a majority of respondents. Energy management systems, water reclamation/graywater collection systems and cisterns, and air purification systems also rated high on the household popularity scale. Some sustainability options have not yet developed a significant level of demand. Electric docking stations to recharge batteries in cars were rated very low in popularity at present.

Not all emerging technologies deal with sustainability. Wireless telecommunication and data transmission systems are seen as growing in popularity by a majority of respondents, while central (distributed) audio/video, security systems, and automated lighting controls are rated as increasing in popularity by a significant minority share of respondents.

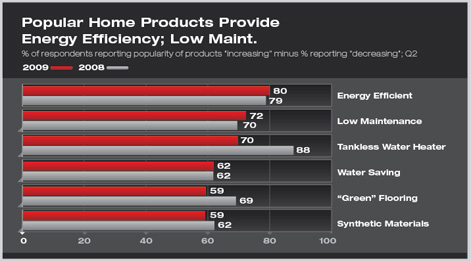

Popular home products share many of the same characteristics of

sustainability and accessibility, with the additional consideration

of being low maintenance. Energy efficient products (for example,

double and triple glazed windows) and low maintenance materials topped

the list of products growing in popularity, with tankless water heaters

close behind. A year ago, tankless water heaters topped the list

of products growing in popularity, but a growing number of respondents

now feel that they have saturated the market.

Water saving and conserving devices, green flooring products, and

synthetic/engineered materials (for countertops, flooring, siding,

exterior trim, and decking) all are deemed as increasing in popularity

by a majority of respondents. Again, though, not all products aimed

at improving sustainability are becoming more common. For example,

heat generating stoves (e.g., pellet stoves) were seen to be increasing

in popularity by a smaller share of respondents than ones who saw

them declining in household interest.

Business conditions appear headed toward recovery

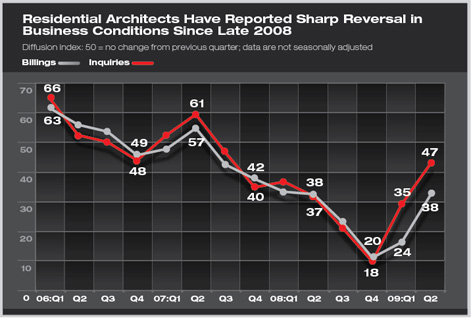

The residential construction markets have been slowing since the first quarter of 2006, and business conditions at residential architecture firms also have been trending down since that time. However, conditions have sharply headed back toward recovery over the first two quarters of 2009. Billings are still declining, but at a much slower pace than at the end of 2008, with the residential billings index increasing almost 20 points over the past two quarters. New project inquiries have done even better, increasing almost 30 points since the end of 2008. Both billings and inquiries still are reported as declining by residential architecture firms, but at a much slower pace in the second quarter.

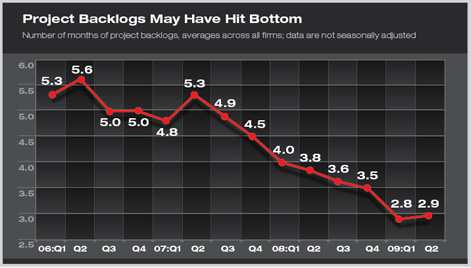

With billings at residential architecture firms declining for about three and one-half years, firms backlogs—the amount of future work currently under contract—has also been declining. Firms currently report backlogs of under three months, down from over five months on average in 2006, over four months in 2007, and over three and one-half months in 2008. With inquiries for new projects appearing to be moving toward a recovery, backlogs may begin to improve over the next quarter or two.

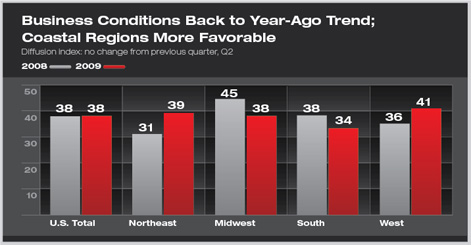

Business conditions are generally weak across the country, but improving in two regions and deteriorating in the other two. Both coastal regions—the Northeast and the West reported very weak billings in the first quarter this year, but the second quarter has seen gains that make a recovery appear to be closer at present. Since the first quarter of the year, billing scores increased by eight points in the Northeast and by five in the West. In contrast, billings scores declined by seven points in the Midwest and four in the South, pushing scores in both of those regions below the Northeast and West.

Lower end of market likely first to recover

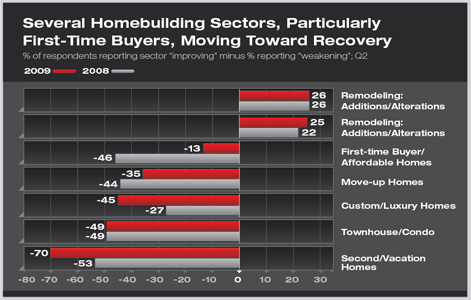

Residential architects work across a broad range of residential sectors, thereby having the ability to compare conditions in many market segments. Early in this downturn, the affordable housing segment was the first to see conditions weaken, as rising house prices and rising interest rates had a greater effect on households trying to purchase their first home. However, as the residential downturn began, the townhouse and condo market, as well as the custom and luxury market, remained relatively healthy.

However, falling home prices—with significant declines in many markets—and stable interest rates have made homes more attractive to entry-level buyers recently. Weak demand in other sectors have finally been felt at the upper end of the market, with custom and luxury homes now seeing falling levels of demand. As a result, affordable homes are the construction segment that appears to be closest to recovery at present, with scores still negative but recovering the fastest. In contrast, custom and luxury homes, as well as vacation homes and second homes, are reporting some of the weakest scores at present. Scores for the remodeling projects have held up better than any of the construction sectors, even though scores have eased just a bit over the past year.

|