Home Sizes Shrink as Downturn Continues

Accessibility, Outdoor Living Remain Popular Features

by Kermit Baker, PhD, Hon. AIA

AIA Chief Economist

Summary: A majority of residential architects report home sizes to be declining nationally, according to the latest AIA Home Design Trends Survey. As the industry heads into the next recovery, the economic downturn may have precipitated the most significant right-sizing of U.S. homes in the country’s history.

Key findings from the AIA’s Home Design Trends Survey for the first quarter of 2009 indicate that in addition to declining home sizes, residential architects report adjustments in the volume of living space (ceiling heights, etc.). Accessibility into and around the home remains a key design concern for homeowners and although lot sizes continue to shrink, households remain very active in property enhancements such as landscaping, outdoor living, and blended indoor/outdoor space.

Weak business conditions persist at residential architecture firms, although there were signs in the first quarter that the market may be nearing its bottom. The affordable housing sector, which was the first sector to turn down this cycle, is currently showing signs that it will be the first sector to recover.

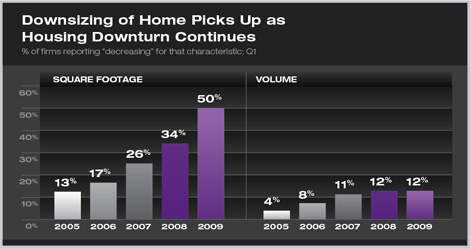

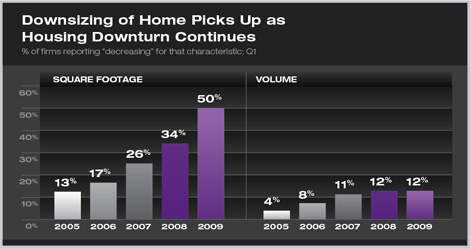

Home sizes historically have declined during housing recessions, but this downturn appears to have ushered in a more dramatic reversal of an extended period of growth in home sizes. In the first quarter, just over half of respondents reported home sizes to be declining, with fewer than 4 percent reporting increases in the size of a typical home. This continues a multi-year trend in the share of residential architects reporting declining sizes, which stood at just 13 percent in the first quarter of 2005 when the AIA began monitoring home design trends. In addition to reporting on the size of the typical home, this survey asked respondents to comment on home size trends for custom/luxury upper-end homes in contrast to entry-level/affordable homes. For both sectors, residential architects were much more likely to indicate declining as opposed to increasing sizes. However, a slightly higher share reported declines in sizes of entry-level homes than saw declines in upper-end homes.

Home volumes (ceiling heights, 2-story foyers, etc.) are also responding to weak demand for housing. A growing share of residential architects sees home volumes declining. With the first quarter survey, a greater share of respondents reported volumes to be declining (12 percent) than reported them to be increasing (11 percent). Concerns over rising home energy costs in the years ahead may be contributing to this trend in home volumes. In spite of a clear trend toward downsizing, households are trying to maximize their useable space in the home. Many more respondents (32 percent) indicate growing interest in finished basements and attics (for homes with these features) than are indicating declines in these activities (12 percent).

Less attention to home layout features

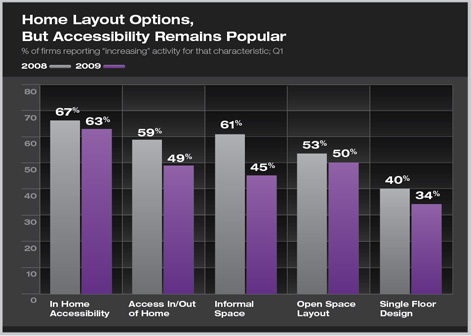

Home layouts have been undergoing a gradual transition for the past few decades. There is less interest among households in formal, fixed-space rooms (e.g., formal dining rooms and living rooms), with growing interest in open space layouts and greater informality in general in the design of interior spaces. Additionally, as our population ages, ease in moving throughout the home and into and out of the home have become greater concerns. Focusing the living space on a single floor, or even designing single-floor homes, also facilitates greater accessibility.

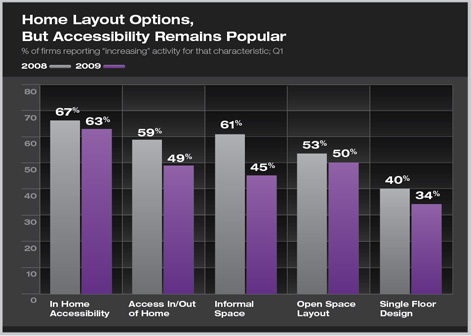

Though these design considerations remain popular, their intensity has eased somewhat with this housing slowdown. For all of these home layout features, the share of residential architects reporting them to be increasing in popularity has declined somewhat from a year ago. In spite of the easing in popularity, interest remains high, particularly for home accessibility design options. As of the first quarter of 2009, 63 percent of respondents saw consumer interest in-home accessibility increasing, with fewer than 2 percent reporting declining interest. There is a similar high interest in accessibility into and out of the home (ramps, on-grade entrances), with almost half (49 percent) reporting increasing interest, and fewer that 1 percent reporting declines. Single-floor home design has a somewhat more mixed level of interest, with 34 percent reporting increases and 6 percent reporting declines.

Smaller lots still generating improvements

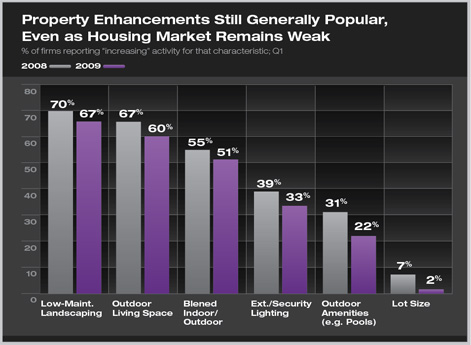

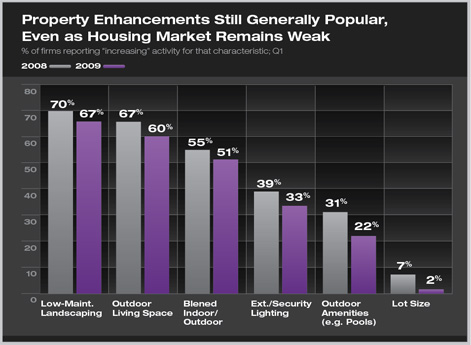

Rising land costs were encouraging smaller lot sizes even before the housing market weakened. The downturn has accelerated that process, as over a quarter of respondents indicate that lot sizes have been declining recently and almost none (under 2 percent) sees lot sizes increasing. In spite of smaller sizes, property improvements remain surprisingly popular.

Two-thirds of residential architects report increasing interest in low-maintenance landscaping (e.g. xeriscaping) while only 4 percent see this feature declining in popularity. The outdoor living trend also remains very popular, not only for decks, porches, and patios, but also for more formal outdoor “rooms” and cooking areas. Related to increased interest in outdoor living is continued strong interest in design features that blend indoor and outdoor space. Both outdoor living and blended indoor/outdoor features are seen as increasing in popularity by a majority of respondents.

Business conditions weak, but stabilizing

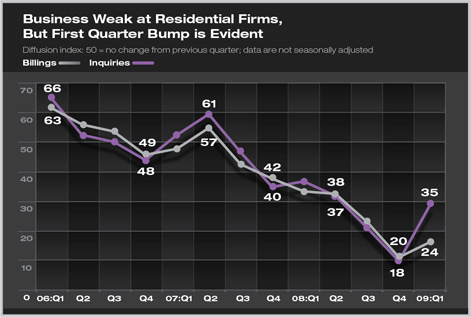

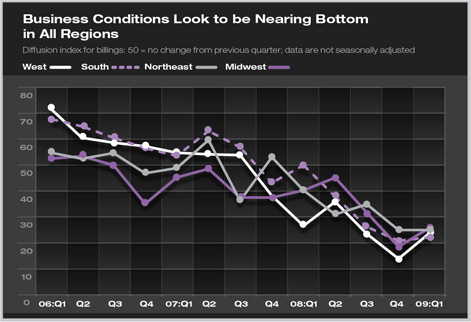

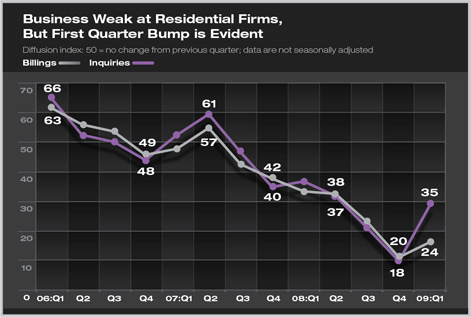

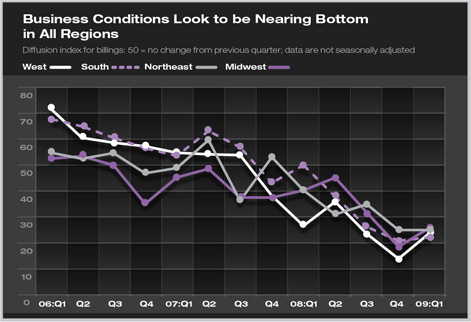

Business conditions at residential architecture firms have been declining since mid-2007 and began to deteriorate more rapidly around the middle of 2008. Although conditions remain very weak, the first quarter figures show signs of this multi-year downturn beginning to reverse direction. The billings index score increased to 24 from 20 in the first quarter, while the inquiries index score increased to 35 from 18.

Any score below 50 indicates that conditions are getting weaker, but evidence that the pace of decline may be beginning to slow is heartening. The way that housing cycles typically play out is that a period of accelerating decline gives way to a period to decelerating decline before the market reaches bottom, which then moves to a period of accelerating growth. While one quarter does not make a trend, the first quarter reading does point to a change in the direction of the cycle. More encouraging is that the biggest movement was for project inquiries, and inquiries would tend to pick up a few months before firm billings.

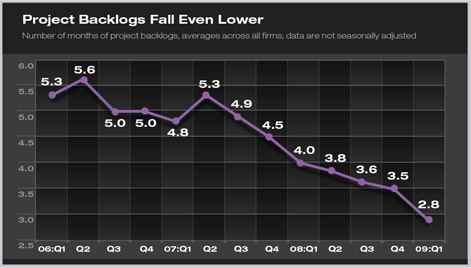

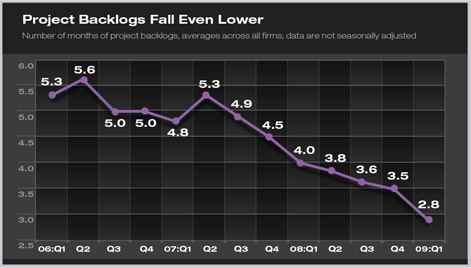

While residential architecture firm billings and inquiries may be showing signs of moderating, firm backlogs (the amount of work in house under contract, measured in comparison to terms of a firm’s expenses) on average are still falling quite rapidly. Current backlogs of 2.8 months are down from 4 months of a year ago, and 4.8 months of two years ago. Seven in 10 firms report backlogs of less than three months, with over half of these firms having backlogs of less than one month.

Business conditions appear to be moderating at firms in all regions of the country, with no region exhibiting significantly better business conditions than others. In recent quarters, conditions have been a bit weaker at firms in the South and West, probably because firms in these regions tend to rely more on new construction activity, while firms in the Northeast and Midwest generally have a greater share of home improvement activity, which generally has fared better than new construction in recent years. By the same token, new construction should rebound faster than home improvements, so firms in the South and West should see a stronger recovery in the quarters ahead.

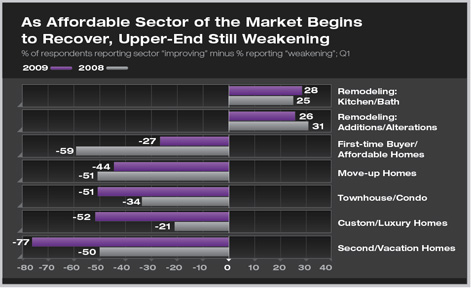

Affordable housing best positioned for a recovery

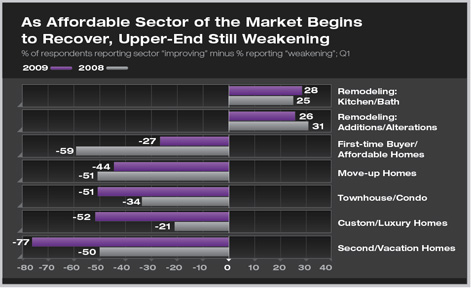

Residential architects are reporting declines in all of the major residential construction sectors, with modest growth in home remodeling activity. However, within the construction sectors, we’re beginning to see a reversal in the direction of key sectors. The affordable housing sector is seeing the least decline at present, but was the sector reporting the steepest decline a year ago. Additionally, this was the first construction sector to weaken, with a negative score in the first quarter of 2005. The custom/luxury construction sector, in contrast, is seeing some of the steepest declines at present, having recorded the mildest declines a year ago. The second- and vacation-home market is currently the weakest, with more than 80 percent of respondents reporting it as weakening, and only 4 percent seeing it as strengthening. This sector was also one of the weakest a year ago, so it has seen very dramatic declines in recent years.

The home improvement sectors have remained healthy in comparison. Scores for both kitchen and bath remodels, additions, and alterations are both indicating growth, and at approximately the same pace as a year ago. Close to half of respondents still see these sectors as increasing, while about 20 percent are reporting declining market conditions.

|