Good Energies’ Green Capital

There’s nothing new about the green economy for this sustainable private investment firm

by Layla Bellows

Summary: Good Energies is an international, mission-centered venture capital firm that uses a diverse group of professionals, including architects, to invest in sustainable technology and building systems. This staff, which also includes physicists, engineers, and MBAs, allows everyone to be more discerning and knowledgeable about the technology they invest in.

Between high gas prices and the stimulus package, the words “solar” and “wind” have had visions of dollar signs dancing in the heads of the typical venture capitalist for just the past couple of years. For the anything-but-typical private investment firm Good Energies, however, investing in renewable energy has been its hallmark since its founding in Basel, Switzerland, in 2001.

“A lot of current investors in clean energy have shifted over from some other technology area because they think clean energy is currently an attractive area,” says Greg Kats, Good Energies senior director and director of climate change policy. “Good Energies has only ever invested in clean energy, and it’s been something we’ve been doing for eight years, so it is really a deep, long-term commitment rather than a transient fad for us.”

Since its start, the company has expanded to open offices in Washington, D.C., New York, London and Toronto, moved its Basel office to Zug, Switzerland and grown its portfolio to encompass green building and energy efficiency technologies, among others. Although Good Energies’ aim is to turn a profit, it takes a singular route for realizing this goal, one that is first rooted in principles and ethics.

The principles

“Good Energies is much more mission-driven than the other venture capital firms,” explains Pat Sapinsley, a senior associate at Good Energies and an architect by trade. “If something doesn’t benefit society and the environment as well as make a profit, we’re not interested.”

Sapinsley is just one example of the assortment of expertise Good Energies has on its staff. This somewhat unconventional team creates a knowledge base that can think beyond the standard number-crunching analysis when evaluating potential investments.

“Because we have an architect on board, we can look at this from an application point of view,” Sapinsley says. “We can look at the very overheated LED market now and say: ‘Well, what is the utility for architects? Would a lighting specifier actually specify this?’”

Oftentimes she’ll also reach out to other experts in the industry for insight as well. When Good Energies was considering an investment in SAGE Electrochromics, Inc., a company that produces electronically tinted glass, Sapinsley was busy making calls to curtain wall consultants while coworkers were looking at financial plans.

“Another venture capital firm might not know that a curtain wall consultant even existed,” she says.

“We think that having a deep base of understanding of technology, industry, and policy is important to making both better investments and helping companies we invest in,” Kats says. For his part, Kats is involved in guiding two Good Energies companies through the process of securing Department of Energy loan guarantees. This kind of hands-on engagement with the companies they’ve invested in is another feature of the company.

“We want to be an active investor,” explains Richard Kauffman, Good Energies’ CEO. “The only thing we do is renewable energy, so we’re going to live or die based on the success of what happens to the companies we’ve invested in within this space. We’re committed to doing what we can to make them successful.”

The investments

Good Energies’ mantra is People-Planet-Profit, and indeed when speaking to their investment companies, one or another aspect of this guiding philosophy tends to come up. SAGE glass clearly serves key functions in caring for the planet through enabling energy efficiency: Its tinting allows control across a huge range of sunlight coming through windows, cutting unwanted solar heat gain on bright, hot days and increasing natural light on overcast days. This allows deep reductions in unwanted solar heat gain and air conditioning and increases daylighting, thereby reducing the need for artificial lighting.

Although he is clearly proud of the building efficiency his product can help create, founder and CEO John Van Dine is equally proud of what it can do for the people inside the buildings where it’s been installed.

“We obviously have a very strong desire as people to have a connection and view to the outdoors,” he says while noting that the use of glass in building envelopes is on the rise to connect building occupants with what’s outside despite its notoriously deleterious effect on insulation, which also means windows have to be covered in some way. Van Dine’s sees his product as preserving what windows are intended for.

“SAGE glass is very much a product that enhances the human experience in buildings,” he says.

The two companies came across each other in 2006 at a conference sponsored by the U.S. Department of Energy. Van Dine was speaking at an event, and, afterward, he and Good Energies’ Michael Ware began discussions that grew to include Kats. It all led to an investment in SAGE Electrochromics, Inc., in 2007.

“The investment in SAGE helped us to expand product development, expand manufacturing process development, and is now helping to put in place volume manufacturing,” Van Dine says. He adds that Good Energies has also brought his company into the fold of its global network—a task that otherwise would have been very costly and possibly would not have been as high in caliber.

Another of Good Energies’ investments in building efficiency is Ice Energy, which produces the Ice Bear hybrid cooling system. In a nutshell, this module freezes water within an insulated storage tank at night, when energy is cheapest and most available, and uses it to cool air conditioning systems throughout the day, when energy is most in demand. The investment made it possible for Ice Energy to transition to a business model where they sold directly to building owners, which provided third-party confirmation of its efficacy, then to one where they sell to utilities, and the utilities provide the Ice Bear to building owners at no cost to them.

Here, too, Ice Energy was a philosophical fit. Ice Energy’s general manager, John McGee, is excited about the product itself, but he gets more excited when talking about its greater ramifications on sustainability strategies in America.

“It actually integrates seamlessly in the power grid,” he says. “There’s a controller that interfaces the Ice Bear directly to the smart grid so that it can be locally scheduled or remotely dispatched. So that’s why in many ways it is a genuine extension of the grid itself.”

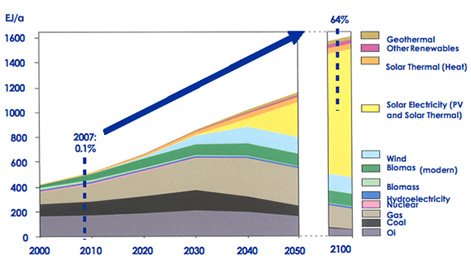

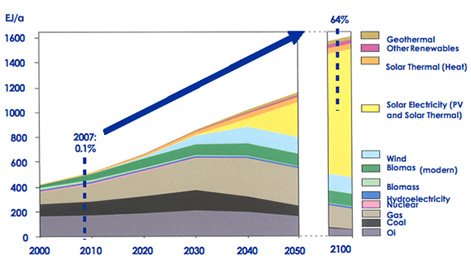

This kind of holistic viewpoint toward the value of a product in its own right and its broader value within overall sustainability practices is something shared by Good Energies and its investment companies. At the end of the day, Good Energies investments—be they in solar, building efficiency, turbine-based renewables, or others—each fits together to provide more comprehensive strategies for an overall goal of lowering carbon emissions and supporting energy transition through investing in companies that enable it.

|