A conversation with McGraw-Hill’s Robert Murray

State of the Economy

by Heather Livingston

Contributing Editor

Summary: Public works will be the only construction sector to see growth in 2009, predicts Robert Murray, the vice president of economic affairs for McGraw-Hill Construction. “The construction industry is showing weakness on numerous fronts,” says Murray, who, with AIA Chief Economist Kermit Baker, PhD, Hon. AIA, presented “The Construction Outlook: Implications for Architecture Firms” at the AIA convention in San Francisco. On a brighter note, Murray says he does see hope on the horizon. Summary: Public works will be the only construction sector to see growth in 2009, predicts Robert Murray, the vice president of economic affairs for McGraw-Hill Construction. “The construction industry is showing weakness on numerous fronts,” says Murray, who, with AIA Chief Economist Kermit Baker, PhD, Hon. AIA, presented “The Construction Outlook: Implications for Architecture Firms” at the AIA convention in San Francisco. On a brighter note, Murray says he does see hope on the horizon.

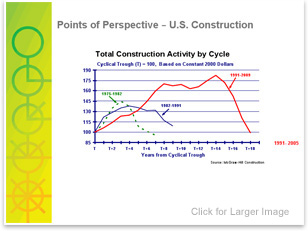

1. The construction cycle from 1991 to 2009, compared to the preceding two cycles, saw a long upward trend punctuated with a precipitous plunge.

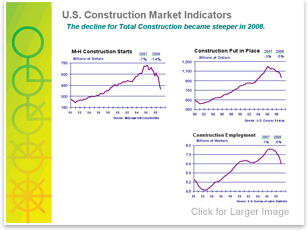

2. The declines in construction are slowing, but still declining.

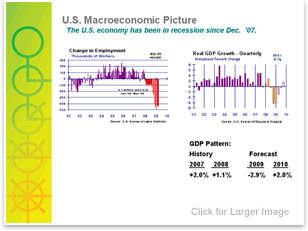

3. The current recession, if it turns around by year-end will be the longest since World War II.

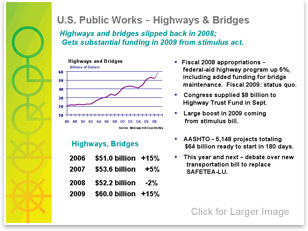

4. Stimulus funds are likely to benefit public works projects this year.

All graphics courtesy Robert Murray and McGraw-Hill Construction.

AIArchitect: Do you feel that the Obama Administration missed an opportunity to simultaneously stimulate the economy and reduce dependency on foreign fuel by neglecting to create a larger tax incentive for residential green renovations?

Murray: It would’ve been nice if there had been more incentives beyond the $5 billion devoted to home weatherization in the bill. I think it gets down to: What is the purpose of the stimulus bill? The primary purpose of the stimulus bill is to increase employment.

AIArchitect: It seems that a larger tax credit would create jobs by helping middle-income homeowners make some improvements. The bill’s incentives are aimed at people on low incomes.

Murray: You could say that the Administration probably missed an opportunity to broaden the bill so that it wasn’t just for low-income households.

AIArchitect: Do you believe that green construction is going to be the industry’s silver bullet or is that just a small portion of the road to recovery?

Murray: We have a very extensive green construction effort at McGraw-Hill. I think it will certainly be a cushioning element and a spur for recovery, but in and of itself, green construction will not help the construction industry recover. There are other elements that have to be dealt with such as the problems with the financial system.

AIArchitect: Are you seeing an easing in the credit market yet?

Murray: There are some signs of easing, but if you look at the current situation relative to the first half of 2008, it’s still a very difficult financing environment for projects. In the most recent quarterly bank-lending survey conducted by the Federal Reserve, 66 percent of the respondents indicated that they had tightened lending standards. This is down from the 79 percent reading in the prior survey. What we’re seeing right now is that the decline is becoming less steep, but it is still a decline. I think there’s light at the end of the tunnel, but we still have a ways to go.

AIArchitect: What area of construction do you expect will begin to recover first? AIArchitect: What area of construction do you expect will begin to recover first?

Murray: The first element of the construction industry that is going to be seeing improvement—at least in 2009—is public works. As a result of the stimulus bill, we are looking for a 10 percent increase in the public works sector, whereas without the stimulus bill it would probably have been a decline of 5 to 10 percent this year.

We are looking at single-family housing to bottom out at mid-2009, stabilize, and then show some improvement in 2010. The percentage increases could be considerable just because it has fallen so substantially. We could be seeing increases for single-family in 2010 on the order of 30-35 percent, but relative to recent history it’s still very, very weak.

For commercial building, it looks like a fairly steep decline is going to be taking place this year, and we’re not looking for a pickup in activity until late 2010 to early 2011. For commercial building, it looks like a fairly steep decline is going to be taking place this year, and we’re not looking for a pickup in activity until late 2010 to early 2011.

The interesting call right now would be institutional building: schools, hospitals, and the like. One of the positives for the building sector in the stimulus bill is the emphasis on energy efficiency improvements for federal buildings. GSA released a list of projects at the end of March that’s fairly extensive. In terms of impact on construction activity, we expect that to begin to show up, if not towards the end of 2009, certainly in 2010.

Also, money has been directed to Housing and Urban Development, which could be a plus to public housing projects next year. But, multifamily housing is in the midst of a fairly steep decline.

With the exception of public works, what you’re talking about in terms of the benefits of the stimulus bill would be a cushioning of the extent of the decline. It’s not going to be able to turn a decline into a gain.

AIArchitect: Do you think that by year-end we’ll begin to see public works projects having a positive effect on the economy? AIArchitect: Do you think that by year-end we’ll begin to see public works projects having a positive effect on the economy?

Murray: There’s been a lot of money directed to public works, and I think a lot depends on the states getting this money out to construction sites and contractors. The early indications are that they’ve been doing that. A drawback and the criticism of the money coming from the stimulus bill is that in many cases it’s directed at smaller-scale projects. Of course, that’s understandable because the purpose of the stimulus bill is to help employment. Large-scale projects take more time to get going, so there’s been less emphasis on them.

Our expectation is that certainly there will be a help to the employment picture in the latter half of 2009. But, given the normal pattern where employment will lag the economy, we’re still going to be seeing fairly high levels of unemployment going into 2010. The problem with that is that it will suppress market fundamentals for the commercial building types and that will continue to make it hard to justify new construction until employment begins to improve. That’s not likely to be an event until some point in 2010 at the earliest. |