Upper-End Kitchen and Bath Features Fall Victim to Housing Downturn

Products on the up promote accessibility for aging or are sustainable

by Kermit Baker, PhD, Hon. AIA

AIA Chief Economist

Summary: Kitchens and baths, long considered to be key areas of focus within the home, are losing some of their attention with the prolonged slump in the housing market. Many upscale products and features are slipping in their appeal given falling home prices in most areas of the country and the renewed concern over housing affordability. Still, other home features have remained popular. Interest in increased accessibility throughout the home, often referred to as universal design, continues to show consumer support, as do products that promote environmental sustainability. Products that have seen the steepest declines in popularity recently are upper-end products that increase housing costs, but that don’t reflect much additional value given current market conditions.

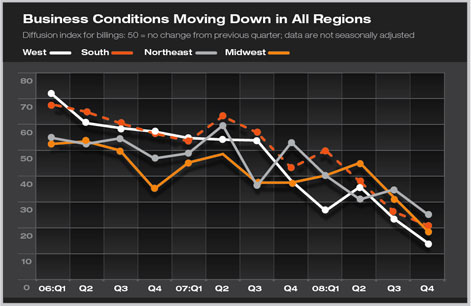

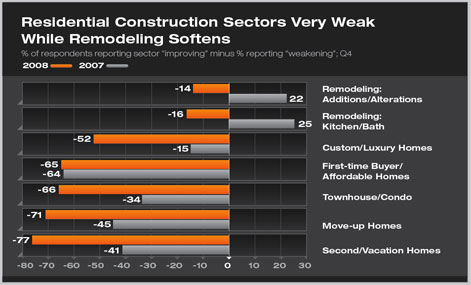

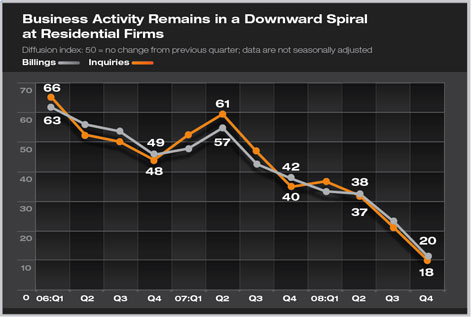

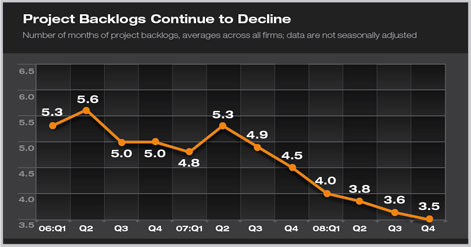

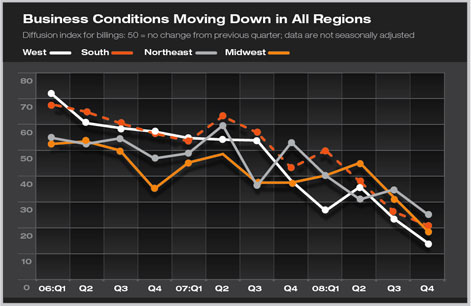

These are some of the key findings on home design developments from the most recent AIA Home Design Trends Survey. Additionally, business conditions at residential architecture firms continue to fall sharply. Both the indexes of firm billings and inquiries are down sharply from a year ago, and are well below any score registered in the four-year history of the AIA Home Design Trends Survey. The weakness in business activity nationally and across all the major regions has reduced firm backlogs quite significantly over the past two years. Residential architects report that all categories of residential activity are declining, but that second/vacation homes as well as trade-up homes are seeing the steepest declines at present, while remodeling projects are seeing more modest declines.

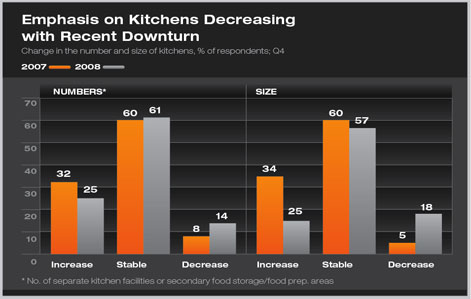

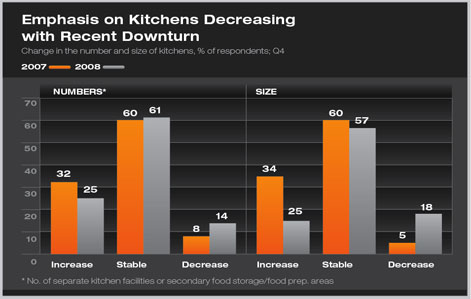

Importance of kitchens on home design waning with weaker market conditions

Residential architects report that the increase in the number of kitchen facilities in a home, including secondary food storage or food preparation areas, has been declining in popularity compared to levels of the past few years. Overall, 25 percent of respondents see these facilities as increasing in popularity, compared to 14 percent that are reporting a decline. A year ago, 32 percent reported increases and only 8 percent reported declines. Trends are very similar for the size of kitchens: the share of respondents reporting increasing size of kitchens has declined from a year earlier, while the share reporting declines has increased quite dramatically. For both the number and size of kitchens, the majority report no significant changes in consumer choices.

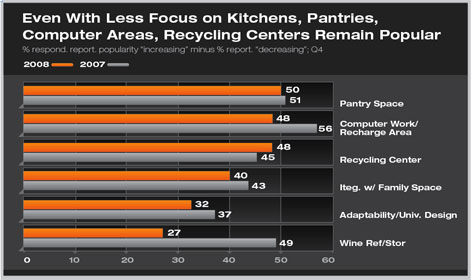

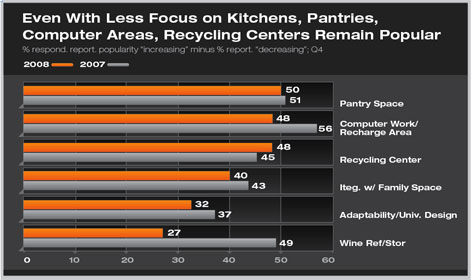

Even with the general easing in the emphasis on kitchens, some features remain very popular. The desirability of pantry space is essentially as popular as it was in the AIA survey of a year ago, and dedicated space in the kitchen for computer use or for recharging electronic devices—such as cell phones or wireless Internet devices—remains very popular. With growing focus on recycling, a dedicated recycling center in the kitchen is also very popular. Integrating the kitchen with family space (such as a great room) and ensuring that the kitchen is designed to promote accessibility also remain popular design objectives. However, some more upscale kitchen features such as a wine refrigerator or a double-island have become significantly less popular over the past year.

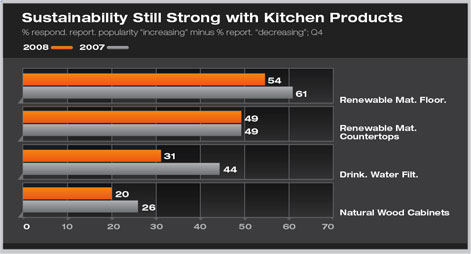

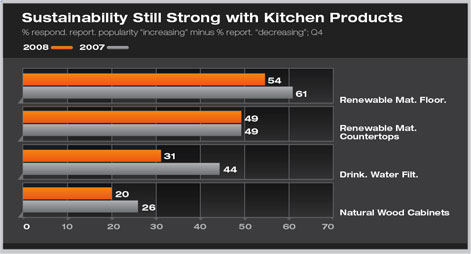

Kitchen products that promote sustainability continue to generate interest in kitchen design. Renewable-material flooring or countertops were both reported to be increasing in popularity in this survey, and by almost the same pace as they were a year ago. Drinking water filtration systems also remained quite popular. Declining in popularity were built-in coffee/espresso makers and warming drawers, while many respondents rated duplicate appliances, pot filler water faucets, natural stone countertops, and upper-end appliances to be losing their momentum in terms of consumer interest.

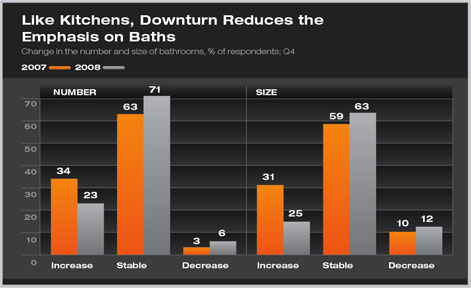

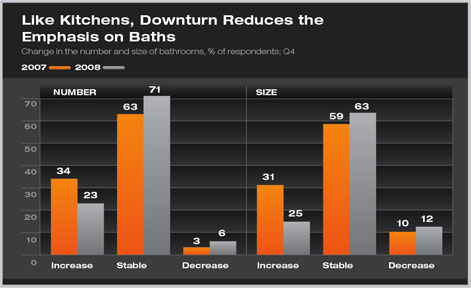

Baths also seeing less emphasis

The number and size of baths in the home is remaining stable according to the overwhelming majority of residential architects responding to the AIA Home Design Trends Survey. However, a smaller share see either the number or size of baths to be increasing, and a growing share see them decreasing compared to the survey conducted a year ago.

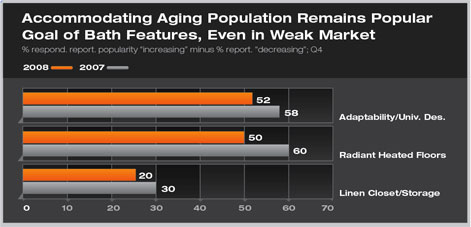

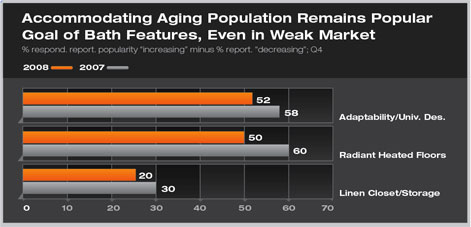

Features that promote accessibility for a less mobile population, as well as radiant heated floors were reported to be increasing the most in popularity by residential architects. Again, more upscale features like duplicate fixtures in the master bath or a separate dressing or make-up area in the bathroom were reported by many to be declining in popularity.

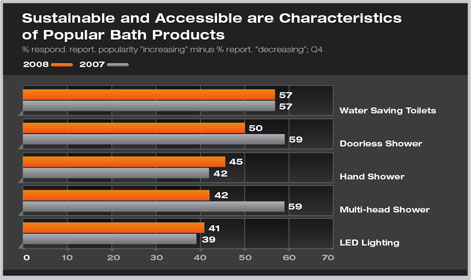

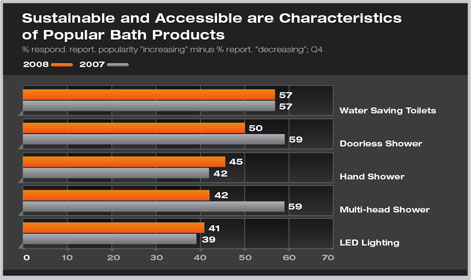

Products growing in popularity in baths reflect these same trends of sustainability and accessibility. Bath products reported as showing the greatest increase in popularity were water-saving toilets, doorless showers, and hand showers. Products that were declining the most in popularity were mostly upscale products: infrared saunas; soaking tubs; steam showers; and towel warming drawers or racks. Some more upscale products like multihead showers and double sink vanities continued to show some popularity, but consumer interest appears to be tapering off.

Business conditions falling sharply

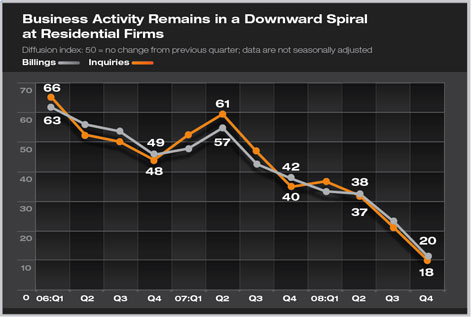

Business conditions at residential architecture firms have been falling sharply since early 2007. The AIA billings index for residential architects fell to 19.5 in the fourth quarter of 2008, down from 42.3 in the fourth quarter of 2007 and 60.9 in the fourth quarter of 2005 (the index scores are not seasonally adjusted, so it is difficult to compare fourth quarter scores with other quarters during the year). Since any score below 50 on this index implies that national billings are falling at architecture firms, a score below 20 points to a very significant downturn in business levels.

The inquiries index holds out no signs for a near-term turnaround in this situation. Inquiries for new projects (e.g., RFPs, invitations for interviews, discussions with prospective clients) are falling just as sharply as billings at these firms. Generally, inquiries are expected to pick up a few months before project workloads, so this index should provide an early indicator of a general turnaround in the residential design profession.

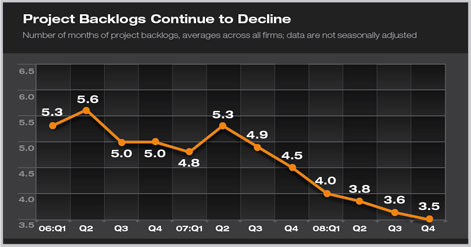

With the falloff in firm workloads over the past several quarters, backlogs have also been declining. Backlogs—the amount of project work currently under agreement, which is typically measured in terms of the number of months that this work would keep current staff employed—averaged 3.5 months in the fourth quarter of 2008, down from 4.5 months during the fourth quarter of 2007 and 5.0 months during the fourth quarter of 2006.

All regions of the country are feeling the effects of the residential downturn. Recently, business has fallen more sharply at firms in the West, which recorded a billings index of 13.9 in the fourth quarter. However, the scores for the other regions—18.5 in the Midwest, 20.8 in the South, and 25.0 in the Northeast—also point to a steep drop in business levels recently. The severity of this international downturn has limited the ability of any local or regional economy to generate even modest gains.

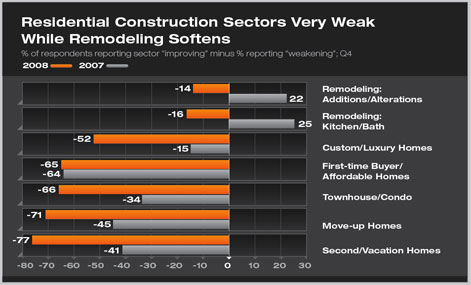

All major market sectors now showing declines

Over the period that this housing downturn has unfolded, the various major residential sectors have performed differently. When the residential downturn first began to take hold in late 2005, the first-time-buyer/affordable-housing sector was the first to weaken. Eventually, weak demand for entry-level housing created problems for the trade-up housing sector, which in turn spilled over into the townhouse/condo and second/vacation home sectors. The custom/luxury sector was the last residential construction sector to feel the effects of this cycle, but by late 2007, even custom/luxury homes were seeing a decline.

Even as the weakness in the residential construction sectors has unfolded, home improvements held up quite well. Only recently have residential architects reported softness in the major home improvement sectors—additions/alterations and kitchen and bath remodels—as falling house prices, credit restrictions, and job losses have discouraged owners from undertaking major home improvements.

At present, the downturn in the entry-level market looks to have begun to stabilize, and the steepest declines are occurring in the second/vacation home sector as well as the trade-up market. The home improvement sectors are seeing the most modest downturns, but until the broader economy and the housing market stabilize, it is unlikely that home improvements will see a turnaround.

|