work-on-the-boards

Conditions Remain Weak for Architecture Firms, but the Bottom May Be in Sight

Credit market problems continue to plague design and construction projects

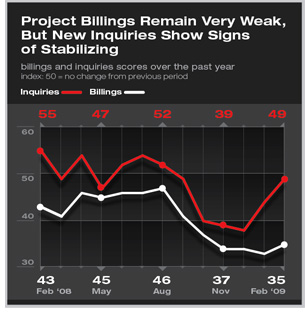

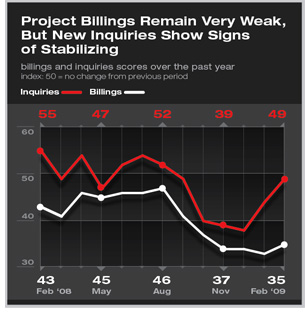

Summary: Business conditions at architecture firms remain very weak, but the period of steepest declines may be nearing its end. The AIA’s Architecture Billings Index moved up two points in February to 35.3. While still pointing to reduced workloads, this score indicates some moderation in the downturn. Even more encouraging is the increase in the index for new project inquiries. The inquiries index has moved up more than 10 points since December, and the February reading of 49.5 suggests that the downturn in project inquiries is stabilizing. Summary: Business conditions at architecture firms remain very weak, but the period of steepest declines may be nearing its end. The AIA’s Architecture Billings Index moved up two points in February to 35.3. While still pointing to reduced workloads, this score indicates some moderation in the downturn. Even more encouraging is the increase in the index for new project inquiries. The inquiries index has moved up more than 10 points since December, and the February reading of 49.5 suggests that the downturn in project inquiries is stabilizing.

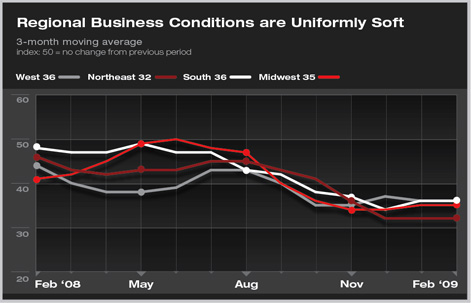

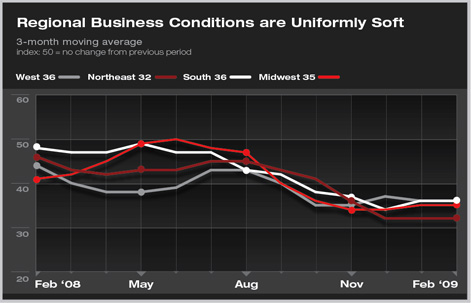

Regionally, no part of the country is yet poised to emerge from the downturn. The coastal areas have reported some of the steepest declines recently, mostly reflecting the weakness in the financial services sector of the economy. The South has generally held up the best, as commodity markets (e.g. agriculture, natural gas, oil) have held up fairly well until recently.

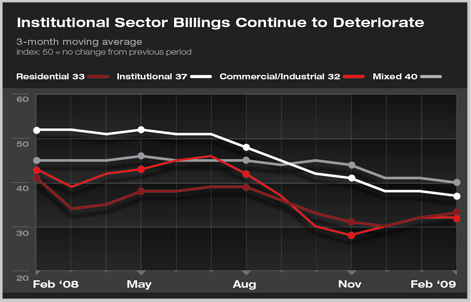

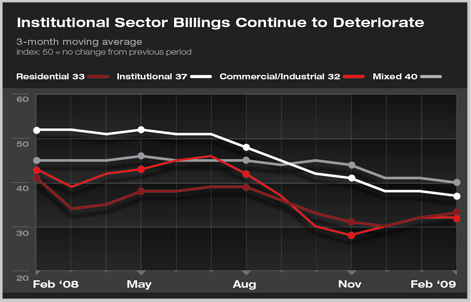

By construction sector, commercial and industrial activity remains moribund, with this index falling even below the residential index in recent months. The institutional sector continues to slip, as index scores for these facilities have remained below 50 for seven consecutive months.

Federal initiatives designed to thaw economy

Like activity at architecture firms, the economy continues to slide. Businesses reported an additional 651,000 payroll job losses in February, with the national unemployment rate rising to 8.1%. The design and construction industry has suffered some of the most serious loses. Fully 17% of payroll losses his year have come from the construction sector, even though this sector accounts for less than 5% of national payrolls. Architecture firms lost over 18,000 jobs between August 2008 and this past January, accounting for 7.5% of all jobs at these firms.

The Commerce Department recently revised down its estimate of the performance of the economy in the fourth quarter of last year, now showing a decline of 6.2% at an annualized rate. Many economists anticipate that the first quarter figures will show another steep drop when they are released in late April. However, as spending kicks in from the federal stimulus program and other related initiatives, economic conditions are expected to improve, with the economy likely to emerge from recession by the end of the year.

Limited credit availability joins weak economy to limit construction projects Limited credit availability joins weak economy to limit construction projects

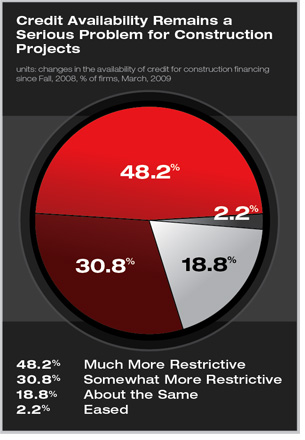

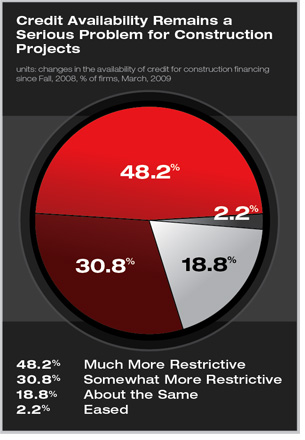

In spite of some signs of improvement in the financial sector, architecture firms report that the availability of credit for construction projects remains a serious problem. In comparison to last fall when project financing emerged as a serious issue, almost half of firms (48%) report that construction financing has gotten much more restrictive in the interim, while an additional 34% report that it has gotten somewhat more restrictive.

In fact, many firms put credit market restrictions on par with the serious economic recession as the principal cause of weakening business conditions at firms. When asked to compare these two factors in terms of their impact on business conditions in the construction sector, 21% selected credit problems for otherwise viable projects as the more serious of the two, while 34% put a weak economy at the top of the list. Over a quarter of firms (28%) rated these problems as a toss-up, while the remaining 18% indicated that it is very difficult to separate credit restrictions from the economic downturn in terms of assessing problems with projects proceeding forward. |

Summary:

Summary:

Limited credit availability joins weak economy to limit construction projects

Limited credit availability joins weak economy to limit construction projects