Canadian Construction Market Looks to Outpace Growth in U.S. Sectors Summary: Although the U.S. economy outperformed the Canadian economy in the last few years, recently there has been a reversal, with the Canadian economy gaining strength as the U.S. economy weakens. CanaData, a division of Reed Construction Data, predicts that nonresidential construction will continue to gain strength through 2007, before beginning to slow. Growth in commercial construction will slow after this year, but institutional construction is expected to remain strong and will continue to grow at near current growth rates through 2010. And although residential construction in Canada is weakening, as it is in the U.S., it is doing so at a slower pace.

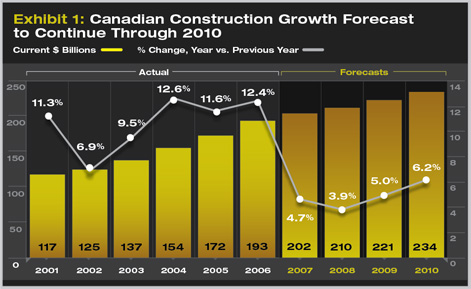

Overall, growth in Canadian new construction spending has been very strong over the last three years (Exhibit 1). Annual growth topped 11 percent for the last three years; however, projections for 2007 indicate that the pace of growth will slow to 4.7 percent, followed by growth of just 3.9 percent in 2008. But starting in 2009, growth in new construction spending is forecast to accelerate once again, reaching 5.0 percent that year and 6.2 percent in 2010. Strong rebound under way

Employment growth in Canada has also been stronger than in the U.S. for most of the past year, showing 2.4 percent annual growth in 2006 compared to just 1.4 percent growth in the U.S. (Exhibit 3). More significantly, growth of construction employment in Canada has actually accelerated over the last several months to just under 4.0 percent in March, while construction employment growth in the U.S. has fallen to nearly 0 percent. CanaData predicts that the Canadian economy will add around 300,000 new jobs per year through 2008, keeping pace with the 315,000 new jobs that were added in 2006.

Residential slowdown

Due to this residential slowdown, CanaData is predicting that new residential construction spending in Canada will decline this year and next, be flat in 2009, and not begin to rise again until 2010 (Exhibit 4). This is in contrast to 13.7 percent annual growth in 2002 at the peak of the housing boom. Nonresidential construction spending, which peaked in 2002 as well with annual growth of 9.4 percent, weakened for the next several years, only to rebound to an estimated 8.3 percent annual growth in 2007. This has served to counteract the losses in residential spending. However, CanaData predicts that growth will steadily slow each year through 2010. Institutional construction spending will grow to have the fastest rate of growth of the nonresidential sectors as it is forecast to maintain an annual growth rate of around 5.0 percent for the next three years. In contrast, commercial construction spending is expected to decline from 11.0 percent annual growth in 2007 to just 1.7 percent by 2010. Industrial construction spending gains will continue flat, hovering around 2.0 percent annual growth for the next three years.

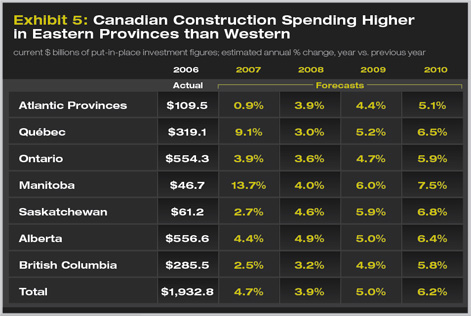

Across the provinces |

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Exhibit 1: 2000 to 2004 are from Statistics Canada; 2005 to 2007 are CanaData estimates based on Statistics Canada survey numbers; 2008 on are CanaData forecasts.

Exhibit 2: Statistics Canada and U.S. Dept. of Commerce, Bureau of Economic Analysis / Chart: Reed Construction Data – CanaData.

Exhibit 3: Statistics Canada & U.S. Department of Labor / Chart: Reed Construction Data – CanaData.

Exhibit 4: 2005 to 2007 are CanaData estimates based on Statistics Canada survey numbers; 2008 on are CanaData forecasts

Exhibit 5: CanaData estimates and forecasts based on Statistics Canada private and public investment survey.