AIA

Home Design Trends Survey

Neighborhood and Community Design Moves Toward Accessibility, Simplicity

Housing downturn puts premium on infill and higher-density locations

by Kermit Baker, PhD, Hon. AIA

AIA Chief Economist

Summary: The

continued weakness in the residential market is changing how communities

and neighborhoods are being designed. There is greater emphasis at

present on integrating homes with activities such as public transportation

and commercial and recreational uses. This in turn has generated

greater density in developments, with infill locations viewed as

popular according to results from the AIA Home Design Trends Survey

for the third quarter of 2009.

Home exteriors are generally simpler, given the attention to affordability

in this economic environment. They increasingly emphasize low maintenance,

durability, and sustainability while, given the denser locations,

porches and other features that encourage neighborhood interaction

also are increasing in popularity.

Business conditions for residential architects remain weak. In the

third quarter, billings on existing projects as well as inquiries

for new projects both stalled at second quarter levels, whereas in

previous quarters these indicators had shown signs of improvement.

Residential architects in the Northeast and West are reporting somewhat

more encouraging conditions than are those in other regions. Affordable

homes for first-time buyers—the first sector to head down when

the housing recession began—appear to be poised for a recovery,

helped in large part by the federal tax credit for first-time homebuyers.

Remodeling activity was reported to strengthen during the quarter.

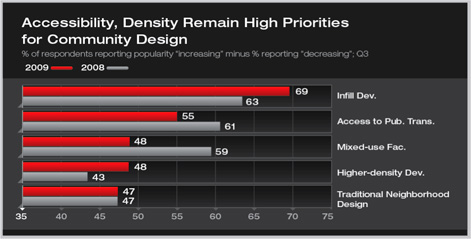

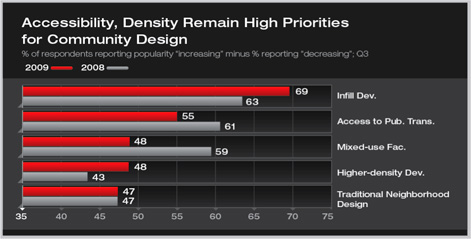

Neighborhood design trends reflect greater integration into the

community

The national housing downturn has produced unusually high inventories

of unsold homes in urban fringe locations. These were the locations

where large enough parcels of land could be assembled to generate

the volume of construction required during the housing boom earlier

this decade. However, when the housing market weakened, large inventories

of unsold homes remained on the market in these locations.

Rising home energy costs prior to this downturn have helped to generate

interest in smaller, more energy efficient homes in locations that

were accessible to transportation, commercial activities, and jobs.

This trend has generated demand for homes in locations closer to

urban centers. As a result, community and neighborhood design priorities

have been shifting. Infill development, with smaller parcels in more

developed areas, has become very attractive according to residential

architects that participate in this quarterly survey. These infill

sites typically have higher densities than exurban locations and

generally are more accessible to public transportation opportunities

and may be part of mixed-use projects (e.g. residential/retail or

residential/recreational) that integrate a wider variety of activities.

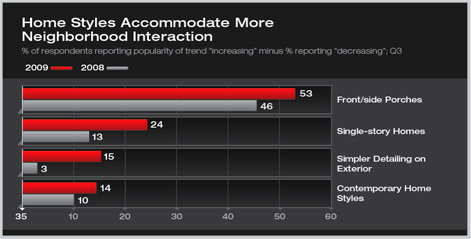

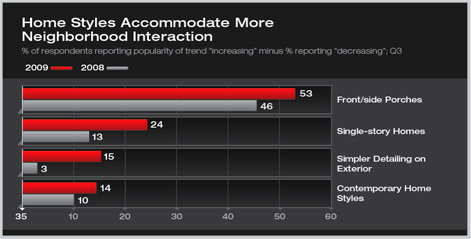

Given the growing interest for greater densities in housing options

located in infill locations, emerging home styles promote greater

neighborhood interaction. Greater use of front and side porches is

mentioned as a trend growing in popularity by a majority of residential

architects. Single-story homes also are becoming more popular, reflecting

lower construction costs in most areas as well as the growing trend

toward accessibility through the home for an aging population. A

growing share of residential architects also report simpler detailing

on home exteriors, again reflecting the need to keep home designs

affordable.

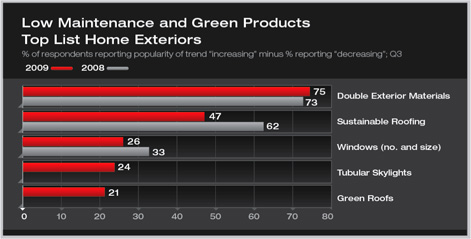

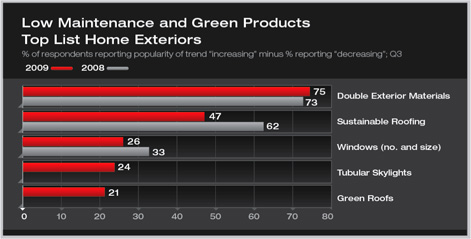

Even with the focus on housing affordability during this downturn,

residential architects report significant interest in low-maintenance

and green products for home exteriors. Three-quarters of respondents

reported growing interest in low-maintenance exterior materials (e.g.,

fiber-cement board and stone) while a majority indicated that consumer

interest in sustainable roofing materials was increasing. Two specific

green exterior products that hadn’t been included in previous

surveys—tubular skylights and green roofs—also were seen

by a sizeable share of residential architects as increasing in popularity,

although apparently off of a fairly small base of consumers that

have undertaken these projects to date.

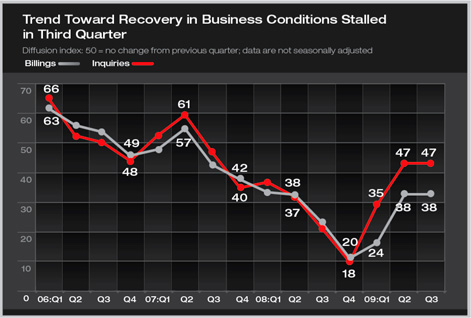

Business conditions remain weak

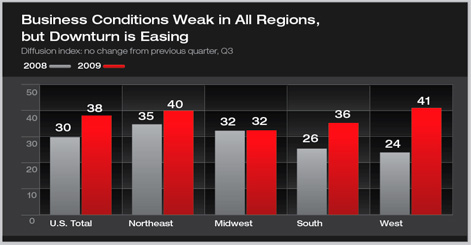

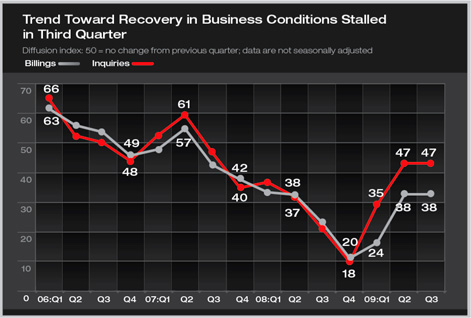

In spite of some emerging signs of improvement in the broader residential

markets, business conditions remain very weak for residential architects.

The index for billings at these firms rose sharply from 20 in the

fourth quarter of 2008 to 38 in the second quarter of 2009. However,

the third quarter figure showed no improvement, and a score of

38 on this index indicates that many more firms are reporting declining

billings than are reporting increases in business activity.

Inquiries for new projects are showing a similar pattern, although

the index scores are higher. Inquiries also have climbed dramatically

since a low in the fourth quarter of 2008 but also leveled off with

the third quarter reading with an index score of 47. Inquiries therefore

are seeing much slower levels of declines than are billings, but

have not yet recovered from their recessionary levels.

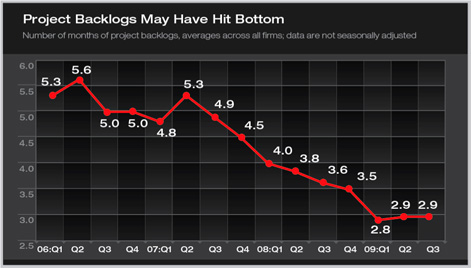

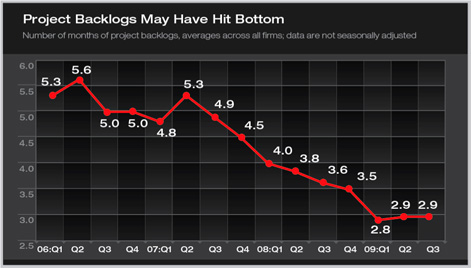

Evidence of continued weak conditions in the profession can be seen

in the levels of backlogs at these firms. Backlogs—the amount

of work currently in-house compared to the amount needed to keep

staff fully employed—have been steadily declining. They reached

a low of 2.8 months in the first quarter of this year and have barely

budged from this level since.

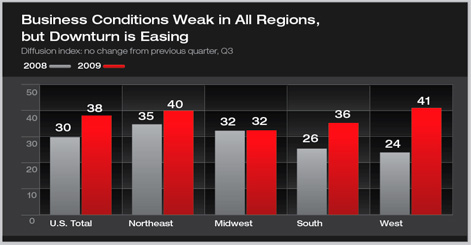

Regional billings activity also has been moving in the right direction,

but firms in all regions of the country are still reporting declines

in revenue levels. The highest index scores are for firms in the

Northeast and Midwest, while the largest gains in index scores are

at firms in the South and West as the housing market begins to recover

in these Sunbelt locations. Still, the third quarter figures don’t

indicate an imminent recovery for firms in any parts of the country.

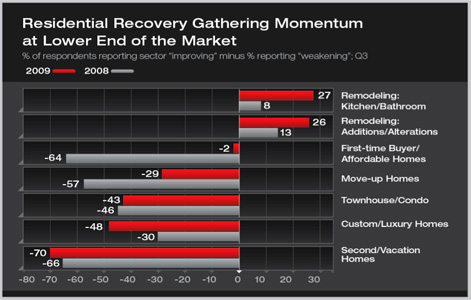

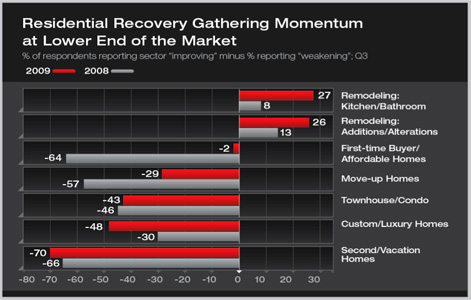

Recovery beginning at the bottom of the housing market

Since residential architects are involved in a broad range of home

design activities, they are in a unique position to compare the

health of different sectors of the housing market. A year ago,

they indicated that the affordable market for first-time buyers

and the trade-up market for households moving to mid-level homes

were among the weakest sectors in the industry. However, falling

house prices over the past year, mortgage rates that have remained

favorable, and the federal government’s tax credit for first-time

homebuyers have all helped shore up the lower end of the housing

market. Currently, these two sectors look to be the closest to

recovery.

The weakest sector at present is the second and vacation home market,

which was also the weakest a year ago. Many households looked to

second and vacation homes as investments, hoping to realize some

appreciation in these properties. With the decline in house prices

nationally, these properties are much less attractive at present.

Home improvement activity has remained much more stable during this

downturn, and many residential architects indicate that kitchen and

bath remodeling, as well as additions and alterations to existing

homes, have increased over the past year. As this housing recovery

continues to unfold, we can expect to see the strength in improvements

to existing homes as well as in lower-priced homes.

|