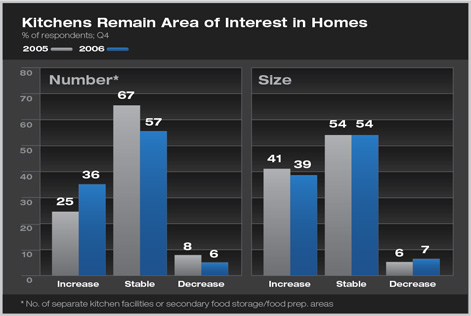

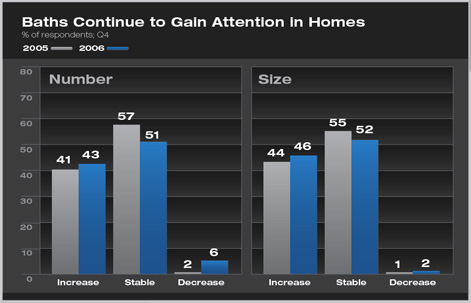

| Homeowner Focus on Kitchens and Baths Not Deterred by Housing Slowdown Upscale features, tempered by growing emphasis on accessibility and sustainability, define emerging trends Summary: Households continue to emphasize size, features, and high-end products used in their kitchens and baths, even as the overall housing slowdown has encouraged many to scale back on their overall housing investment. Although homeowners continue to look for upper-end features in their kitchens and baths, there is an emerging interest in making these areas of the home more accessible and adaptable for an aging population, and in using more “green” features in these rooms. These are some of the key findings from the AIA Home Design Trends Survey for the fourth quarter of 2006. Residential architects report a continued slowdown in housing activity nationally and in every major region of the country. While conditions are weakening for virtually all types of homes, home remodeling activity is reported as stable or improving by the overwhelming majority of architects serving this residential sector. Kitchens attracting additional activities

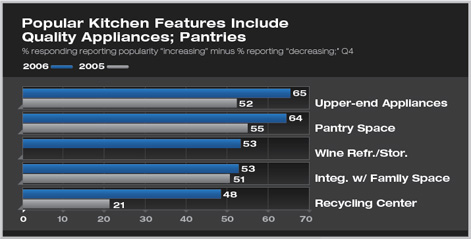

Kitchens remain popular because they house more activities. Upper-end appliances are becoming more popular, even for homes that are not at the upper-end of the price range. Pantry space is increasing, as are wine storage areas and recycling centers. The integration of kitchens with informal living space (great rooms) also remains a popular design. Island work areas, duplicate appliances, computer work areas, and warming drawers are also seen as growing in popularity, but by a smaller share of respondents.

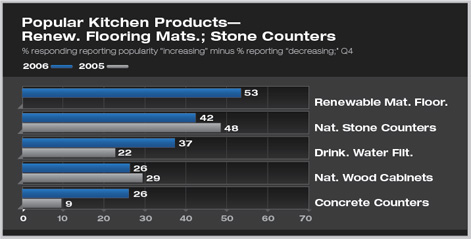

With natural products becoming more common in kitchens, so are “green” products. More than 60 percent of respondents see renewable material flooring (e.g., bamboo) as increasing in use, while fewer than 8 percent see it declining. Natural stone counters are still seen as more popular, although at a somewhat slower pace than a year ago, while over 41 percent of residential architects reported concrete countertops—considered a renewable product—to be increasing. Almost 16 percent of respondents see concrete countertops to be declining in popularity, producing a net score of 26 (41.5 percent reporting “increasing,” 15.5 percent reporting “decreasing”). This score is well up from a year ago, when 30 percent reported increasing popularity and 21 percent reported decreasing, producing a net score of 9. Drinking water filtration systems also are reported to be gaining compared to responses from a year ago.

Baths retain focus

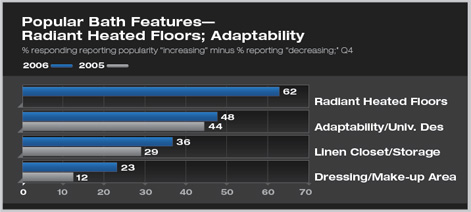

Radiant heated floors top the list of bath features that are growing in popularity. Bathrooms designed for accessibility, containing features such as no-threshold showers, also continue to make significant inroads. Increased storage space and make-up areas in bathrooms also are reported to be seeing more interest.

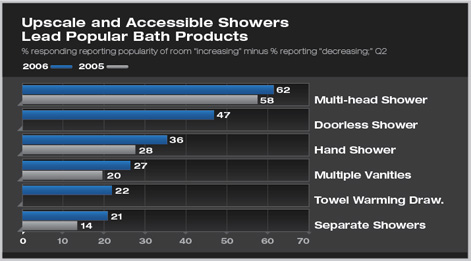

Many of the bath products that are generating the most interest by consumers are upscale shower features, or features that make showers more accessible. Multihead showers are seen to be growing in popularity by a majority of residential architects, while separate showers are seen to be increasingly present in homes by a smaller number of respondents. Doorless showers and handheld shower heads are popular features that can make a bath easier to use. Multiple vanity sinks, towel warming drawers or bars, and to a lesser extent steam showers and double-sink vanities are bath products that have generated interest by consumers.

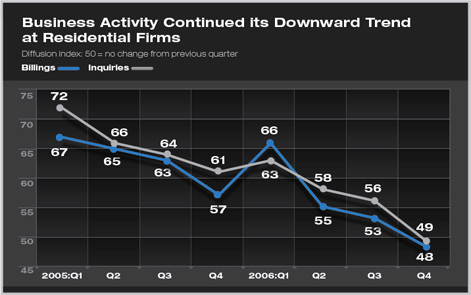

Business conditions weakening

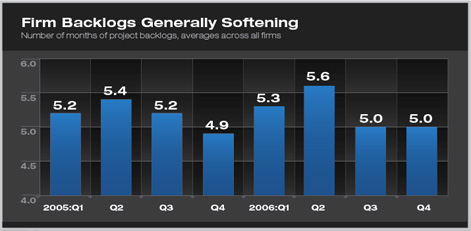

Project backlogs, however, have not suffered as much erosion as the easing in business conditions might suggest. In the fourth quarter, backlogs (the amount of work under contract at the firm) averaged five months, unchanged from the third quarter, and even up slightly from a year ago.

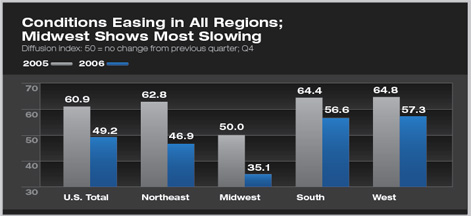

The national slowdown in business conditions is being felt in all regions, although the results of this downturn range from continued growth at a much slower pace for firms in the South and West, to a modest decline in the Northeast, to a significant downturn in the Midwest. However, given that this easing is partly seasonal (the fourth quarter is traditionally a slow period), we may well see improvement in some regions of the country in the first quarter.

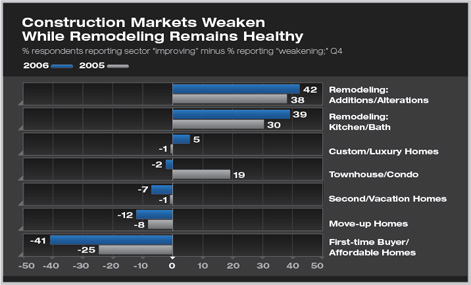

For virtually all of the construction sectors, residential architects reported weaker numbers at the end of 2006 than they had a year earlier. Conditions for entry-level homes (typically for first-time buyers) are particularly weak, as 48 percent of respondents see this market as weakening, while only 7 percent see it as improving. For move-up homes, second and vacation homes, and townhouses and condos, more residential architects see conditions as weakening as see them improving. For custom and luxury homes, conditions are seen as moderately improving over the past year. On the other hand, conditions remain strong for home improvement projects. Over half of the respondents see addition and alteration projects to existing homes as improving, as do 44 percent of respondents for kitchen and bath remodels. With relatively few seeing either of these sectors as weakening, both earned high net scores in the fourth quarter.

|

||

Copyright 2007 The American Institute of Architects. All rights reserved. Home Page |

||

news headlines

practice

business

design

Recent Related

› Homeowners Looking for Greater Accessibility to Services and More Mixed Uses in Communities and Neighborhoods

› High Energy Costs Inspire New Features in Homes

› “Bigger Is Better” No Longer Ruling Home Design

› Residential Architects Report Strong Design Focus on Kitchens and Baths