McGraw-Hill's Bob Murray Offers Construction Outlook at AIA convention

"To

me, one of the biggest benefits we get from the AIA's strategic alliance

with McGraw-Hill Construction is access to Bob Murray and his work,"

said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. Baker was introducing

Robert Murray, McGraw-Hill Construction's Vice President of Economic Affairs,

to the audience of the annual McGraw Hill Construction Outlook seminar

at the AIA convention May 11 in Charlotte. McGraw-Hill's Construction

Group Publisher Norbert Young, FAIA, concurred, saying that Murray's work

really set the standard for understanding the broad dynamics of what was

going on in the country.

"To

me, one of the biggest benefits we get from the AIA's strategic alliance

with McGraw-Hill Construction is access to Bob Murray and his work,"

said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. Baker was introducing

Robert Murray, McGraw-Hill Construction's Vice President of Economic Affairs,

to the audience of the annual McGraw Hill Construction Outlook seminar

at the AIA convention May 11 in Charlotte. McGraw-Hill's Construction

Group Publisher Norbert Young, FAIA, concurred, saying that Murray's work

really set the standard for understanding the broad dynamics of what was

going on in the country.

Murray said that he was hearing lots of differing opinions and looking at lots of cross currents for what is happening and what was going to be happening in construction. He hoped to offer conference participants a "weather report" of construction activity for the rest of 2002 and 2003. In a nutshell, he expects construction to decline by 2% in 2002, and then to climb 4–5% in 2003.

The economy overall

Looking at overall U.S. construction market indicators, particularly construction

put-in-place, the industry's best indicator of spending, Murray said,

"I really don't see a recession there." Individual construction

sectors overall seem to back this up. Several—but not all—sectors

in the construction market showed weakness last year. Murray predicts

that 2002 will finish up with slower growth, despite overly encouraging

numbers early this year that were "pumped up by warm weather."

Large-scale indicators for the overall U.S. economy show an evening from the slump of last year. Although the GDP showed a 5.8% burst of growth in the first quarter of this year, "you won't see this in the second and third quarters; there will be a slowdown," Murray said. And although stocks haven't bounced back yet, Murray predicts the market will pick up before the end of the year. But, he warns, as part of the evening-out process, there will be no great boom, just as there was no great bust. He also sees little reason for concern over the current dip in employment. "April already shows a slight pickup," he said, reminding the audience that employment typically lags behind the overall economy.

Bolstering the macroeconomics picture, a survey of bank lending officers shows that some 50 percent indicate that they are tightening their lending standards, which is a "contributing element to correction" within the commercial building market, according to Murray. Likewise higher insurance costs (an after effect of the September 11 terrorist attacks) have dampened construction plans. On the other hand, the push for smart growth in a slower economy offers a big plus for commercial development: downtown redevelopment.

Outlook by building types

Housing (-3% change

from last year)

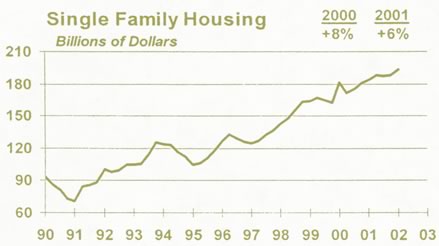

Single-family housing is "now at full throttle," Murray said.

"It's hard to find anything wrong with single-family housing."

The sale of single-family homes, the best measure of demand, remains high

after breaking all records earlier this year. Mortgage rates are still

hovering at 7%. Expect some creep by the end of the year, Murray predicts.

The potential dampening effect on single-family housing is the rising

unemployment rate—Murray predicts a 3% drop in single-family housing

this year (the National Association of Home Builders is predicting a 3%

increase). Still, Murray reminded the audience, single-family housing

is proceeding at a reasonably healthy pace.

Multifamily housing is fairly stable right now, in part because the real-estate finance community sees it as a safe haven, Murray explained. It is expected to be down 1% this year, and that's a very positive picture.

Commercial income

properties (-6%)

"Anyone whose market is commercial buildings right now is feeling

the pain," Murray said.

• Stores and shopping centers have shown a drop-off in construction

since their all-time high of 1999–2000. The market for stores and

shopping centers should see an 11% decline in square feet built in 2002,

and stabilize in 2003.

• Warehouses are in a nosedive this year—they are expected to

decline by 20% in terms of square feet built.

• Hotels, although experiencing a brief surge last year (following

a surge in convention center work) had already begun the downturn that

this sector currently is experiencing before the September 11 terrorist

attacks. 2002 will bring a 25% decline in construction, with larger hotels

absorbing a greater percentage of the decline. Although some forecasters

are predicting growth in the hotel markets later this year, Murray doesn't

see a rebound until 2003.

• The office market varies considerably by region, so areas must

be examined individually, Murray explained. For instance, in the largest

metropolitan-area office markets, new construction ranged from -45% in

Seattle and San Jose, to +92% in New York City, and +43% in Los Angeles.

The bad news is that overall this year, office building construction will

drop 17%. The good news is "the correction process is working,"

Murray said. "It won't be a seven-year process."

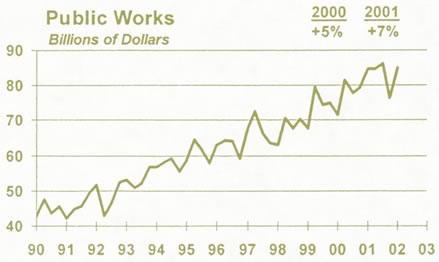

Public buildings

(and public works): (+1%)

On the downside for public buildings are deficit budgets faced by the

great majority of states. Public works will likely feel the adverse effect

in 2003 and 2004. One bright spot for public buildings, though: The Bush

Administration's proposals for FY 2003 include raising the General Services

Administration's renovation program 19% (to $986 million) and new construction

44% (to $557 million).

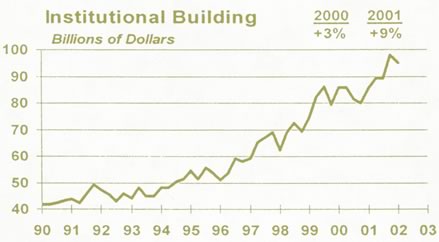

Institutional buildings:

(+2%)

• School construction is now at a record high. So, Murray asked,

"what's not to like?" The upward trend probably will break this

year, but still remain strong, given predicted enrollment levels, he said.

• With health-care buildings, this year should bring a modest increase

in hospitals and overall stability for this year.

• Courthouse construction should slide down a bit this year, while

prisons seem to have leveled off.

• Religious buildings are holding their own, with a stable 50 million

square feet of construction predicted for this year.

Overall, Murray reminded the audience that in a down market, renovation work gets a larger share, and that is what we are seeing now. Additionally, he cautioned that there would be no rip-roaring recoveries, just as there have been no rip-roaring recessions. "The construction industry is more stable now than in the 1980s or 1970s, helped by the continued strength for single-family housing and an offsetting pattern by sector," he said. "While 2002 will be another down year, the stage is set for improvement in 2003."

Copyright 2002 The American Institute of Architects. All rights reserved.

![]()

|

Charts from McGraw-Hill Construction. |

|